Your Path to Financial Freedom Starts Here!

Simplify your investment journey with expert guidance from Rajeev Bansal, NISM Certified Investment Advisor (Level 1), AMFI registered Mutual Funds Distributor (MFD)

ARN: 294326, E554034

*Mutual funds investments are subject to market risk, please read scheme related documents carefully.

What Is Your Investing Style?

Key Characteristics:

- Invests only in safe and fixed-return products like Fixed Deposits, PPF, NSC, and Government Bonds.

- Avoids market-linked investments like equities or mutual funds.

- Risk tolerance is very low.

- Suitable for those nearing retirement, with short-term financial goals, or seeking guaranteed income.

Asset Allocation -

Fixed Returns: 100% Equities: 0%

Key Characteristics:

- Majority of investments in fixed-return instruments (e.g., FDs, Bonds, Debt Mutual Funds)

- Small allocation to equities (e.g., blue-chip stocks, diversified mutual funds) for slightly higher returns.

- Risk tolerance is low, with limited capacity for market volatility.

- Suitable for those who are preserving capital with some potential for growth.

Asset Allocation -

Fixed Returns: 70–90%

Equities: 10–30%

Key Characteristics:

- Diversified portfolio including equities, debt, and alternative investments like gold.

- Seeks medium-to-long-term growth while managing downside risk.

- Risk tolerance is medium, with some acceptance of market fluctuations.

- Suitable for those who are looking for wealth creation with moderate risk and steady returns.

Asset Allocation -

Equities: 40–60%,

Debt: 30–40%,

Gold/Other: 10–20%,

RECOMMENDED FUNDS:

Key Characteristics:

- Majority of investments in equities (direct stocks, equity mutual funds, sectoral funds)

- Minimal to no allocation in fixed-income or guaranteed-return products.

- Risk tolerance is high, ready to endure significant short-term market fluctuations.

- Suitable for those who are investing for long-term wealth accumulation, significantly outpacing inflation.

Asset Allocation -

Equities: 80–100%

Debt/Gold/Other: 0–20%

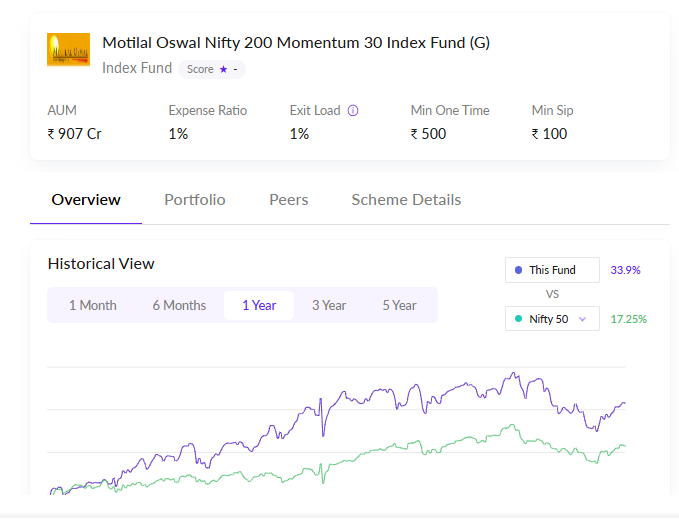

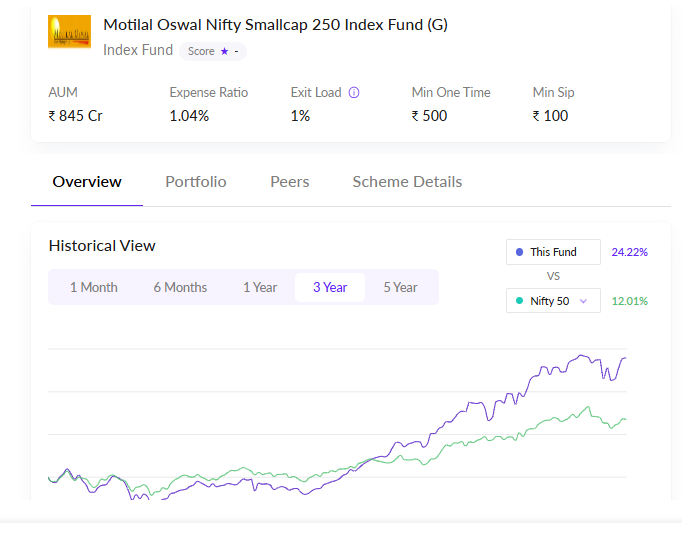

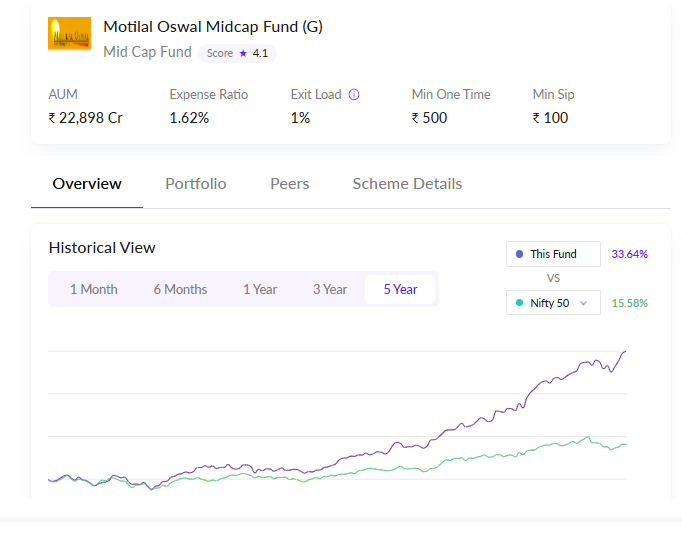

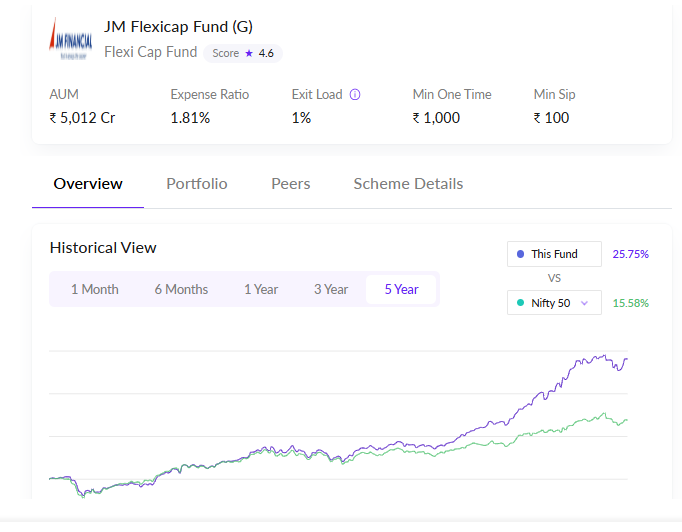

RECOMMENDED FUNDS:

Our investor base spans across various industries and backgrounds.

With 22+ years of investment experience, I’ve honed our strategies and built a proven track record of success.

-

01. Personalized portfolio recommendations

01. Personalized portfolio recommendations -

02. Comprehensive risk assessment

02. Comprehensive risk assessment -

03. Regular portfolio reviews and updates

03. Regular portfolio reviews and updates -

04. Maximized returns with tailored strategies

04. Maximized returns with tailored strategies

testimonials

Rajeev Bansal is a remarkable professional whose dedication and expertise stand out in every project he undertakes. His innovative approach and keen analytical skills enable him to tackle complex challenges with ease. Rajeev's collaborative spirit and leadership qualities make him an asset to any team. I wholeheartedly recommend him for any endeavors he chooses to pursue, as he consistently delivers results that exceed expectations.

I had known Rajeev since he was head of Costing & MIS for the towel division at the Trident. He was responsible for our monthly report card, the profitability statement. We used to have a few interesting discussions during the beginning of the month on this. The product Costings too were provided by his department. He was an authority in his subject. Along with it, he was a people’s person. The combination of the two qualities has resulted him in becoming an entrepreneur. Today he is providing investment consultancy to the professionals, including ones with strong commercial/ financial background. Wishing him all the best!

Rajeev is a very matured and seasoned professional already had worked in many of big manufacturing houses and handled business and finance side understand the directions and swing of business now he in a different role and in which I personally fine him very calculated and person who takes next step with a clear understanding to maximize the return on investment his analysis on the market trend is marvelous and frankly speaking I always take steps now in field of investment only with his advise. All the best to Rajeev 👍

RB has a very astute understanding of Equity Market and very clear on fundamentals and logics. His best skill is his patience which most of the seasoned professionals in this field lack at times. His calculations are so accurate that sometimes it really seems like magic. You can definitely pursue your financial goals successfully with him as a mentor.

Rajeev Bansal is hands on financial advisor who has seen corporate working as a management accountant and understand all aspects of financial management. He is trustworthy and dependable person. I wish him all the best

Rajiv sir has made my life easy. I am always fond of learning more about finance and he has explained everything to me in such an easy manner which I never felt could be possible. Gratitude to him for always guiding me on my doubts.

5 Proven Strategies for Mutual Fund Success

Learn the Secrets of Smart Investing – For Free!

Let’s work together

Get personalized consultation call from me and my team.

Start instantly with Wealthy

FAQs

Your Questions,

Answered.

What are mutual funds, and how do they work?

A mutual fund is an investment vehicle that pools money from multiple investors to invest in stocks, bonds, or other assets. A professional fund manager manages these funds, aiming to grow your investment over time or generate regular income.

With mutual funds, you can diversify your portfolio without needing in-depth market knowledge, making it an excellent choice for beginners and seasoned investors alike.

How much money do I need to start investing in mutual funds?

The good news is, you don’t need a large sum to begin! Many mutual funds allow you to start with as little as ₹500 through a Systematic Investment Plan (SIP). This flexibility makes mutual funds accessible for everyone, regardless of their financial standing. You can also checkout our financial calculators to assess you much you need to invest monthly.

Are mutual funds safe investments?

All investments carry some level of risk, and mutual funds are no exception. However, they are managed by professionals and regulated by SEBI (Securities and Exchange Board of India), ensuring a high level of transparency and accountability.

With the right guidance—like personalized advice from WealthInFocus—you can choose funds that align with your risk tolerance and financial goals.

How do I know which mutual fund is right for me?

The best mutual fund for you depends on your financial goals, risk tolerance, and investment horizon. For instance:

- If you want steady income, debt funds might suit you.

- If you’re aiming for long-term growth, equity funds could be ideal.

Rajeev Bansal will help you identify the perfect funds based on your unique needs.

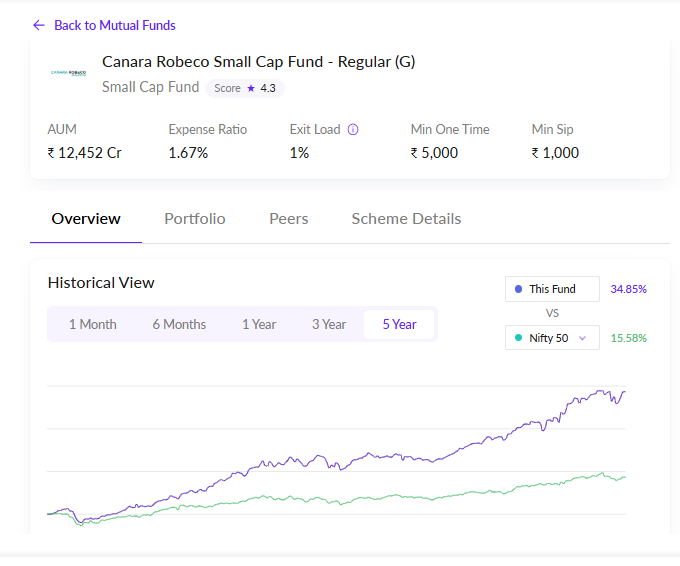

What happens if I need to withdraw my money?

Mutual funds offer flexibility when it comes to withdrawals. You can redeem your investment partially or fully at any time. However, some funds may have exit loads (a small fee) if you withdraw before a certain period. Rajeev will guide you on the best strategies to avoid unnecessary costs while meeting your financial needs.